Any search for information related to commercial drone technology will pull up a variety of articles from Colin Snow, aka the Drone Analyst, CEO and Founder of Skylogic Research. The info he’s laid out in these pieces ranges from a realistic look at the growth prospects in the drone market to a breakdown around why agriculture and farming would not be the largest driver of sUAS commercial businesses to an exploration of diversity and hype in market forecasts. They demonstrate his unmatched expertise when it comes to assessing how drones have and will be used in a variety of commercial applications.

However, the analysis he’s laid out in these pieces is just of hint of what he fully explores in his market reports that go beyond the hype and headlines of the drone industry. His

2018 Drone Market Sector Report has set a new standard for drone industry surveys, as it includes the results of interactions with 2,500 drone buyers, service providers, business and public agency users, and software service users, plus insights into the verticals that use drone data. The 107-page research report is an incredible resource for anyone who wants to get a clear picture of how drones are actually being used in a variety of commercial settings, and what all of this means for the future of the technology.

To get a better understanding of the insights from this report that he

talked through at Commercial UAV Expo, we connected with Colin to ask him a few specific questions. He explained what’s really behind DJI’s dominance, why the surveying / mapping / GIS services segment presents the most opportunities for service providers, how he’s seen his reports impact the approach companies take to drone adoption and much more.

Colin is also set to discuss some of these insights during the

Commercial UAV Trends Panel at the

DJI AirWorks event, taking place October 30

th – November 1

st in Dallas.

Jeremiah Karpowicz: You’ve noted the sharp rise in the number of companies that offer drone market reports, but also that things have somewhat slowed with those reports this year. Does that mean the drone industry is finally working its way through the trough of disillusionment, or just that we’re due for another barrage of reports in 2019?Colin Snow: Look, we still believe the #1 misconception in the drone industry is how fast it will grow, which sectors will grow, and which ones will lag. We have written about this problem as far back as 2015 in a piece called

Diversity and Hype in Commercial Drone Market Forecasts and another in 2017 called

Why the Drone Network of Tomorrow is Farther Away than You Think.No one disagrees that drones—both consumer and professional—represent a new and emerging market. Drone market forecasts abound. We currently track 84 independent companies that provide market forecasts, and each of them projects growth for the drone or unmanned aerial system (UAS) sector that is nothing short of phenomenal. Some of these, however, are questionable, because at the time they were written, there were no historical sales or reliable market survey data on which to create a proper forecast.

That said we certainly hope the industry is working its way through the trough of disillusionment, but still, we are seeing promos for many new drone market reports covering topics like LiDAR drones, Infrared payloads, ADS-B, drone-based service providers, UTM, and urban air mobility. Most of these come from firms outside the U.S. For example, the U.K. and India. The problem with most of these reports is their method of prediction – not to mention they have little idea what is really happening on the ground here in North America. They’re not built on actual market data, just predictions from the firm itself or their query of leaders inside the industry. Most of the numbers are very inflated or they include companies that no longer have a presence in the market like eHang and Airware.

Even so, some ask us if we expect the business adoption to “take off” some time soon. To be honest, we don’t see a tipping point soon or anytime in the future. For lots of reasons, we think growth will be incremental, not exponential. I know a lot people point to BVLOS as the soon to be inflection point where we will see hockey growth curves. We don’t and to be clear – a few of us have been making this clarion call for years now.

Still, we believe there are “triggers” that will drive increased business demand, but most of these are out of control of DSPs or drone vendors. The triggers include a variety of factors such as:

- Digitization and technology adoption varies by industry

- Business risk aversion

- Concerns over invasion of privacy

- Reluctance to share too much information about successes

One of the findings you shared during your presentation at Commercial UAV Expo that was focused on your 2018 Drone Market Sector Report centered on how DJI’s market share actually went up over last year but didn’t increase as much as it did from 2016-2017. Do that disparity tell you more about the market itself, or DJI’s place in it? Yes, DJI continues to dominate the market and has made gains this year in every product category—from drone aircraft at all price ranges, to add-on payloads, to software.

For example, our data shows DJI is the dominant brand for drone aircraft purchases, with a 74% global market share in sales across all price points, and an even higher share (86%) of the core $1,000–$2,000 price segment. This is up from 72% and 84%, respectively, over last year.

Our data also shows DJI dominates the drone aircraft payload market. Its Zenmuse RGB camera / sensor / gimbal combination now accounts for nearly a third (31%) of all purchases—a big increase from last year, when it represented only 4%.

In the three categories of software we evaluated, DJI is the market-share leader in two: flight logging and operations, and automated mission planning.

As I noted in last year’s report, much of DJI’s dominance can be attributed to DJI’s aggressive product development, technological advancements, and partner development in its enterprise channel. DJI’s leadership role existed as early as 2015 when we looked at FAA data on commercial drone registrations. The company continues to release new product after new product, and it leads other manufacturers with technology and enterprise ecosystem partnerships.

We predicted last year that this would continue well into the future, given their current lead, their strategic partnership investment with Hasselblad, their recent investment in an R&D facility in Palo Alto, California, and the continuation of their AirWorks Conference enterprise partner ecosystem event.

Previous reports of yours have indicated that the Aerial Photography and/or Video is the biggest market for drones, but the surveying & terrain mapping segment has the most opportunity. That was backed up in your 2018 report, but what can you say about how the opportunities in surveying & terrain mapping are distinct and different from the other segments you’ve analyzed?

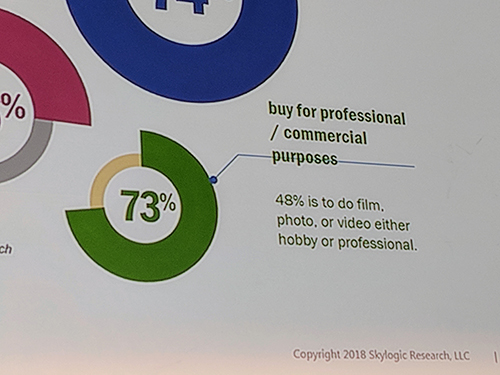

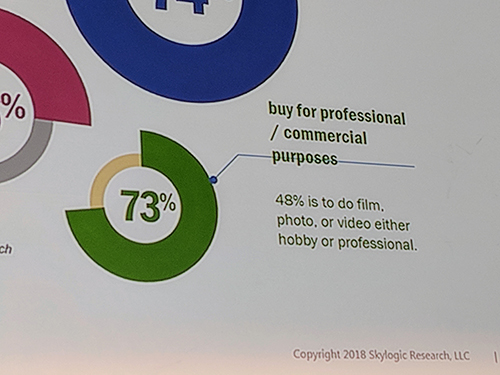

Previous reports of yours have indicated that the Aerial Photography and/or Video is the biggest market for drones, but the surveying & terrain mapping segment has the most opportunity. That was backed up in your 2018 report, but what can you say about how the opportunities in surveying & terrain mapping are distinct and different from the other segments you’ve analyzed? Let’s start with drone-based service providers. In this segment film / photo / video is the #1 professional intent for using drones. However, just because it represents the largest usage segment doesn’t mean these firms are making money. Most aren’t. It’s actually those who offer surveying / mapping / GIS services that make the most. Of the top 10 most prevalent services that make more than $100,000 in revenue, those that offer surveying / mapping / GIS services are at the top. Utilities infrastructure inspection or monitoring is #2.

When we look at business users we see is an almost identical story. To be clear, the business and agency users who took our survey come from a wide variety of backgrounds – about 60 industries were represented. We asked them questions about the primary mission of their commercial use, and whether they outsource some or all of that work. What we find is aerial Photography and/or video is the #1 mission and Surveying / Mapping / GIS is #2, and construction (design, building, inspection, or monitoring) is #3.

So yes, this year, our analysis finds that the provisional use of drones by many industries stands in sharp contrast to that of the surveying / mapping / GIS firms that have been aggressively testing and using drones for several years now. These firms specialize in a specific service and serve as a conduit for drone data and other types of GIS information needed for business operations. This also explains why so few of these firms outsource. Almost all of their customer contracts come with strict accuracy requirements. In fact, they’re so strict that the aerial RFPs require specialists to answer. All of this means they must maintain control of the entire process—from sales to data capture, to processing, to reporting.

Your report lays out ten different insights, all of which are fully explored in specific detail in the report. One that really stood out to me was about how service providers and businesses are thinking about drone insurance, and that it’s basically an afterthought. Is this due to challenges with the process of securing insurance, assumptions that nothing bad is going to happen while operating a drone, or something else? In our survey, we asked both service providers and business users about their UAS specific insurance coverage. I was a bit shocked as well to find done insurance appears to be an afterthought. Despite the huge risks drone operations bring, our data shows that only about half of the service providers (54%) and less than half of businesses or agencies (45%) carry UAS-specific liability coverage.

As to why almost half don’t carry insurance, I don’t have an answer.

Perhaps the good news is that about a quarter of the firms or agencies we surveyed do plan to get UAS-specific liability coverage in the next 12 months. The other good news is that about a third (27%) of those that do carry UAS-specific liability coverage take advantage of low-cost hourly/daily on-demand liability plans. A few vendors offer automated platforms that let commercial drone operators self-manage coverage solutions online. Typically, operators can purchase flight liability coverage on-demand—for as little as a day or as long as a year—with a range of limits.

How have you seen or heard about your reports being utilized to impact the approach companies take when it comes to the adoption or integration of drone technology? Yes, there are some big success stories in dronelandia—successes that can be attributed in great part to managing with data we have provided. Take

DroneDeploy, for example.

They report over 30,000 users that log over 65,000 flights per month. These users have mapped over 250,000 sites and uploaded more than 75 million images in the last 12 months.

By our accounting DroneDeploy has the #1 market share for agriculture and construction in automated flight / mission planning and data / image / video processing—despite having 16% and 12% overall share in those two software categories, respectively.

DroneDeploy operates in one of the most crowded segments of the commercial drone market—software. We track over 130 vendors servicing the two software categories in which they compete. Last year our data showed they lead with more agriculture industry market share than anyone but lagged in construction. This year, however, they targeted construction, and the results show it.

One reason for DroneDeploy’s success is they were able to track their results with data—data that we provided from custom queries tailored to their objectives that were included in their research sponsorship over the past two years.

What would you say to someone who’s interested in getting their hands on your full report, but aren’t sure they’re going to be able to justify the expense for it? One thing they can do is look at the report prospectus and determine if the report is something that will provide value. It provides an executive summary of the report as well the background and methodology we use. It lists the demographics of the 2500 plus respondents who took our survey as well a list of the content, figures and chart, and survey questions.

Readers can download that prospectus or purchase the report here:

http://droneanalyst.com/research/research-studies/2018-drone-market-sector-report-purchase or if they have questions they can write me

[email protected]  Previous reports of yours have indicated that the Aerial Photography and/or Video is the biggest market for drones, but the surveying & terrain mapping segment has the most opportunity. That was backed up in your 2018 report, but what can you say about how the opportunities in surveying & terrain mapping are distinct and different from the other segments you’ve analyzed? Let’s start with drone-based service providers. In this segment film / photo / video is the #1 professional intent for using drones. However, just because it represents the largest usage segment doesn’t mean these firms are making money. Most aren’t. It’s actually those who offer surveying / mapping / GIS services that make the most. Of the top 10 most prevalent services that make more than $100,000 in revenue, those that offer surveying / mapping / GIS services are at the top. Utilities infrastructure inspection or monitoring is #2.When we look at business users we see is an almost identical story. To be clear, the business and agency users who took our survey come from a wide variety of backgrounds – about 60 industries were represented. We asked them questions about the primary mission of their commercial use, and whether they outsource some or all of that work. What we find is aerial Photography and/or video is the #1 mission and Surveying / Mapping / GIS is #2, and construction (design, building, inspection, or monitoring) is #3.So yes, this year, our analysis finds that the provisional use of drones by many industries stands in sharp contrast to that of the surveying / mapping / GIS firms that have been aggressively testing and using drones for several years now. These firms specialize in a specific service and serve as a conduit for drone data and other types of GIS information needed for business operations. This also explains why so few of these firms outsource. Almost all of their customer contracts come with strict accuracy requirements. In fact, they’re so strict that the aerial RFPs require specialists to answer. All of this means they must maintain control of the entire process—from sales to data capture, to processing, to reporting. Your report lays out ten different insights, all of which are fully explored in specific detail in the report. One that really stood out to me was about how service providers and businesses are thinking about drone insurance, and that it’s basically an afterthought. Is this due to challenges with the process of securing insurance, assumptions that nothing bad is going to happen while operating a drone, or something else? In our survey, we asked both service providers and business users about their UAS specific insurance coverage. I was a bit shocked as well to find done insurance appears to be an afterthought. Despite the huge risks drone operations bring, our data shows that only about half of the service providers (54%) and less than half of businesses or agencies (45%) carry UAS-specific liability coverage.As to why almost half don’t carry insurance, I don’t have an answer.Perhaps the good news is that about a quarter of the firms or agencies we surveyed do plan to get UAS-specific liability coverage in the next 12 months. The other good news is that about a third (27%) of those that do carry UAS-specific liability coverage take advantage of low-cost hourly/daily on-demand liability plans. A few vendors offer automated platforms that let commercial drone operators self-manage coverage solutions online. Typically, operators can purchase flight liability coverage on-demand—for as little as a day or as long as a year—with a range of limits.

Previous reports of yours have indicated that the Aerial Photography and/or Video is the biggest market for drones, but the surveying & terrain mapping segment has the most opportunity. That was backed up in your 2018 report, but what can you say about how the opportunities in surveying & terrain mapping are distinct and different from the other segments you’ve analyzed? Let’s start with drone-based service providers. In this segment film / photo / video is the #1 professional intent for using drones. However, just because it represents the largest usage segment doesn’t mean these firms are making money. Most aren’t. It’s actually those who offer surveying / mapping / GIS services that make the most. Of the top 10 most prevalent services that make more than $100,000 in revenue, those that offer surveying / mapping / GIS services are at the top. Utilities infrastructure inspection or monitoring is #2.When we look at business users we see is an almost identical story. To be clear, the business and agency users who took our survey come from a wide variety of backgrounds – about 60 industries were represented. We asked them questions about the primary mission of their commercial use, and whether they outsource some or all of that work. What we find is aerial Photography and/or video is the #1 mission and Surveying / Mapping / GIS is #2, and construction (design, building, inspection, or monitoring) is #3.So yes, this year, our analysis finds that the provisional use of drones by many industries stands in sharp contrast to that of the surveying / mapping / GIS firms that have been aggressively testing and using drones for several years now. These firms specialize in a specific service and serve as a conduit for drone data and other types of GIS information needed for business operations. This also explains why so few of these firms outsource. Almost all of their customer contracts come with strict accuracy requirements. In fact, they’re so strict that the aerial RFPs require specialists to answer. All of this means they must maintain control of the entire process—from sales to data capture, to processing, to reporting. Your report lays out ten different insights, all of which are fully explored in specific detail in the report. One that really stood out to me was about how service providers and businesses are thinking about drone insurance, and that it’s basically an afterthought. Is this due to challenges with the process of securing insurance, assumptions that nothing bad is going to happen while operating a drone, or something else? In our survey, we asked both service providers and business users about their UAS specific insurance coverage. I was a bit shocked as well to find done insurance appears to be an afterthought. Despite the huge risks drone operations bring, our data shows that only about half of the service providers (54%) and less than half of businesses or agencies (45%) carry UAS-specific liability coverage.As to why almost half don’t carry insurance, I don’t have an answer.Perhaps the good news is that about a quarter of the firms or agencies we surveyed do plan to get UAS-specific liability coverage in the next 12 months. The other good news is that about a third (27%) of those that do carry UAS-specific liability coverage take advantage of low-cost hourly/daily on-demand liability plans. A few vendors offer automated platforms that let commercial drone operators self-manage coverage solutions online. Typically, operators can purchase flight liability coverage on-demand—for as little as a day or as long as a year—with a range of limits.

Comments