We often refer to the drone “industry” as if it were a set collection of people and groups that are all working toward the same goal, but that really is not the case. The efforts of organizations like the Small UAV Coalition as well as the AMA have influenced the changes we’ve seen with Part 107 regulation, but their focus is justifiably geared toward their members rather than this undefined “drone industry” as a whole.

It’s an important distinction to make, because this industry is one that many have talked about as being incredibly lucrative. Colin Snow mentioned on Twitter that he keeps an on-going list of UAS drone forecasts, and he was up to 41 at the time. Suffice to say, exactly how lucrative this industry will be is a matter of discussion, but no one is denying the potential impact these tools could have in various industries and markets.Being able to take advantage of these opportunities is something people inside and outside of this industry are looking to be able to do, but their means of doing so have been limited to practical applications of the technology that simply are not feasible or applicable to everyone. That’s why the very first ETF (exchange-traded fund) focused on the commercial drone market is such a milestone. Investing in the drone industryCalled IFLY and created by PureFunds, the ETF provides an instrument for investing in this omnipresent technology segment. The Fund seeks to provide investment results that will serve the investor as well as this drone “industry” that we can define as the manufacturers, service providers and anyone else interested in seeing drones realize their full potential.“This ETF was developed to be an opportunity for anyone who was interested in investing in the drone industry,” said Andrew Chanin , CEO at PureFunds. “We see it as a burgeoning industry right now with plenty of buzz, media coverage, and all sorts of companies trying to enter the space. Being that it is a burgeoning industry, we wanted to create an investment vehicle for those interested in investing.”The creation of the ETF comes at a critical time, not just because of changes like Part 107 but also because we’re finally starting to see how drones are making an impact in real world situations. New use cases for drones are popping up constantly, and that’s because of things like an increase in payload capacity and the distances these tools can travel. We’ve moved beyond just talking about potential, as operators of all types and sizes are seeing and exploring how they can and want to utilize the capabilities that drones currently and will soon possess.

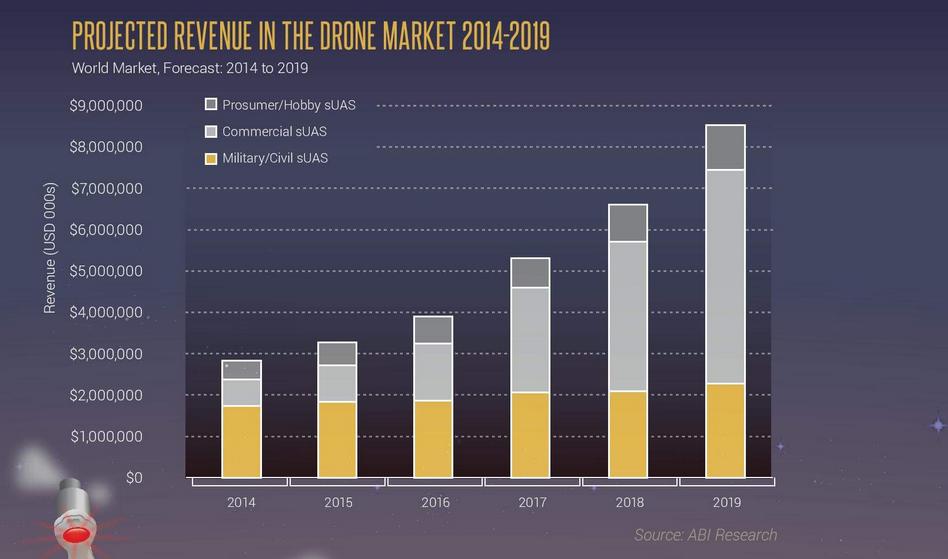

Source: Investing in the Drone Economy

All of these markets have specific investment opportunities, but how drones can and will be part of those opportunities is ill-defined. That’s one of things that makes IFLY different. It’s an opportunity for anyone to specifically get involved and support this technology is it rolls out across these various markets.“Before we launched our fund, there weren’t many options for pure play or even much exposure to these industries,” Chanin said. “Your typical initial options for other funds like, say, cyber security or mobile payments, only allow you to invest in a very broad-based fund and hope you get some exposure to the industry you believe in. Because IFLY is so specific, we feel it provides a very real value.”The speed of the technology means that new use cases and capabilities will be continually developed, and being able to take advantage of such things will be a constant challenge. The opportunity to invest in IFLY allows backers to know they’re helping to forge strong relationships with people in the drone community and create countless opportunities. Does IFLY make sense for you?Ultimately, questions about whether or not IFLY is a worthwhile investment need to be answered on an individual level, as no one can predict what the future holds for such a unpredictable industry. Nonetheless, IFLY presents a tangible opportunity for anyone who wants to support and benefit from where things are headed.“IFLY is for someone that believes in the growth in this industry and wants to have a diversified play in this industry,” Chanin concluded. “When you invest in IFLY, you’re investing in over 40 companies doing various things throughout the industry. As this industry grows there will be many different players that will fill roles in this ecosystem, and IFLY provides a way for investors to get exposure to many companies from around the world of various sizes that are actively working in the drone industry.”It’s tempting to want to compare IFLY to other investment options, but that can be a difficult comparison since the drone industry is constantly evolving. As the industry changes and new companies emerge, PureFunds will have the ability to add those into the fund. It’s one of the great things about investing in the space via ETF.While the "drone industry” will continue to be an amorphous concept, supporting the growth and expansion of this industry is not with options like IFLY. Being able to profit from that support can just be an added bonus.

All of these markets have specific investment opportunities, but how drones can and will be part of those opportunities is ill-defined. That’s one of things that makes IFLY different. It’s an opportunity for anyone to specifically get involved and support this technology is it rolls out across these various markets.“Before we launched our fund, there weren’t many options for pure play or even much exposure to these industries,” Chanin said. “Your typical initial options for other funds like, say, cyber security or mobile payments, only allow you to invest in a very broad-based fund and hope you get some exposure to the industry you believe in. Because IFLY is so specific, we feel it provides a very real value.”The speed of the technology means that new use cases and capabilities will be continually developed, and being able to take advantage of such things will be a constant challenge. The opportunity to invest in IFLY allows backers to know they’re helping to forge strong relationships with people in the drone community and create countless opportunities. Does IFLY make sense for you?Ultimately, questions about whether or not IFLY is a worthwhile investment need to be answered on an individual level, as no one can predict what the future holds for such a unpredictable industry. Nonetheless, IFLY presents a tangible opportunity for anyone who wants to support and benefit from where things are headed.“IFLY is for someone that believes in the growth in this industry and wants to have a diversified play in this industry,” Chanin concluded. “When you invest in IFLY, you’re investing in over 40 companies doing various things throughout the industry. As this industry grows there will be many different players that will fill roles in this ecosystem, and IFLY provides a way for investors to get exposure to many companies from around the world of various sizes that are actively working in the drone industry.”It’s tempting to want to compare IFLY to other investment options, but that can be a difficult comparison since the drone industry is constantly evolving. As the industry changes and new companies emerge, PureFunds will have the ability to add those into the fund. It’s one of the great things about investing in the space via ETF.While the "drone industry” will continue to be an amorphous concept, supporting the growth and expansion of this industry is not with options like IFLY. Being able to profit from that support can just be an added bonus.

Comments