While reports about the billions of dollars that the commercial drone market represents aren’t as pervasive as they used to be, these sorts of predictions continue to create unfounded expectations that can leave operators and investors feeling as if their belief in the technology is misplaced. Thankfully, there are also reports that are focused on the reality of drone technology in the present and future. The 2019 World Civil Unmanned Aerial Systems Market Profile & Forecast is one of those reports.

Created by the Teal Group, the aerospace and defense consultancy has been focused on these markets for the past 31 years. That focus has driven their annual forecasts and market analysis on both civil/commercial markets and military markets where drones are now making such a big impact. The 2019 World Civil Unmanned Aerial Systems Market Profile & Forecast features 10-Year Market Forecasts, an analysis of what to look out for over the next decade, an analysis of the involvement of venture capital in the drone market, an analysis of the strategies companies are using to position themselves in the market and much more.

As Director of Corporate Analysis at Teal Group and author of the UAS Market Profile & Forecast, Phil Finnegan has incredible insights around where things are and where they’re headed with the market and technology. He is set to share some of these insights at the Commercial UAV Expo during the View into the Future panel, which will showcase a variety of experts and their vision & predictions for the future of this industry. In preparation for that session, we connected with Phil to learn more about his report and the drone market as a whole.

Jeremiah Karpowicz: As we all know, there are numerous reports and predictions about where the drone market is and what it’s worth, so what can you tell us about what makes your report distinct and worthwhile?

Phil Finnegan: In general, Teal Group reports on activities in the markets that we cover, so our reports are not intended to really drive market events, but rather report on them and analyze them and predict market responses. With respect to the global UAS market, our goal is to present a realistic view of the civil/commercial market so companies and investors can better target growth opportunities.

Teal Group has been specifically covering this market for two decades, and it obviously started with the military market that was first to evolve, but as the civil market emerged, Teal Group began to focus on it. So we have a long experience studying this market as well as a good understanding of the developments and organizations that are driving it.

What kind of an impact do reports that have talked about the billions of dollars that the drone market represented meant for the industry as a whole? Has that hype helped or hurt adoption?

Unfortunately, there have been reports that were overly optimistic about the speed at which some of the elements in the market would develop, and that has led to a misallocation of investment funds. There needs to be a recognition of the limits posed by regulatory issues, by technological issues, and by the need for businesses to develop the plans to integrate these systems and to understand the economics of them. Many of these reports don’t consider such realities.

Right now, there are some extremely optimistic forecasts being made about the viability of air taxis over the next few years. We don't include unmanned air taxis in our report because we believe near-term prospects are based on that hype. The FAA is still reluctant to allow UAS to operate even with several pounds of cargo. We've seen Amazon's plans delayed for years now. To expect that the FAA will become comfortable with unmanned air taxi's in the next decade or more is unrealistic and leads to that misallocation of investment dollars.

When we hear news about companies like Airware and CyPhy Robotics going out of business, should that be cause for concern or just the reality of the growth of a nascent industry?

There's a continual evolution of market conditions and players in any industry. Mature industries move slower than new, innovative industries. The global UAS industry is young and dynamic – as a result, some companies, platforms and solutions will succeed and some will fail, and that's to be expected. These kinds of developments are a normal part of the development of a nascent industry.

Some of this stems from the unrealistic expectations of the market that we just talked about. Companies that believe the market will grow more rapidly than is realistic might spend their funding too quickly. There has been a considerable amount of venture capital funding in the drone industry, and that creates a cutthroat drive to create revenue and show growth. That also makes profitability increasingly difficult to achieve, but it’s not a phenomenon unique to the global UAS market.

Many of the companies that we see in the industry now won't be around in five years. Some will be acquired as larger companies try to broaden their own businesses, while many others are simply going to run out of funding and go under. That doesn't mean it's a bad business. In fact, it's a great market. It just means these companies need to develop their business plans carefully. They need to ensure the company has enough money and time to succeed. They need to be realistic about the growth of their target segments, and how regulatory issues will speed or slow growth. They need to understand the competitive landscape and recognize the potential for disruption from a company like DJI. But they also need to be nimble enough to shift their business plans as the market itself shifts.

How are those shifts explored and addressed in the 2019 World Civil Unmanned Aerial Systems Market Profile & Forecast?

We've seen a number of companies pivot from manufacturing to services and software. It’s a rapidly evolving industry and market, and we try to provide market participants with a realistic and comprehensive view of the market.

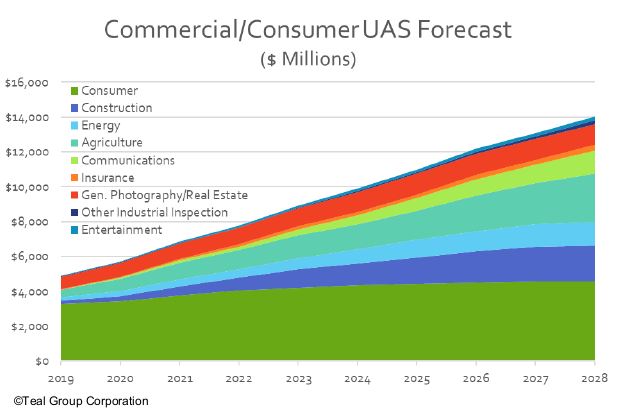

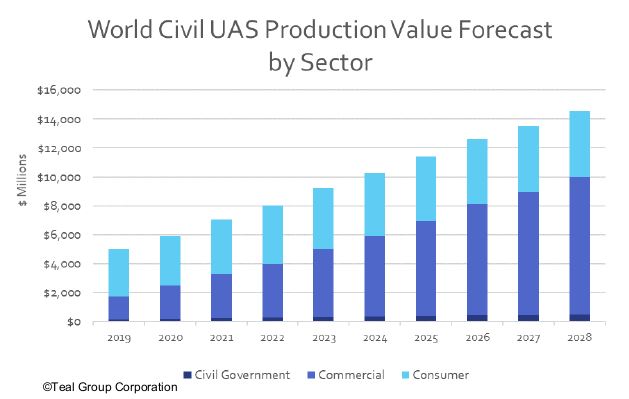

The report looks at the type of systems being demanded, different growth rates, different regions and verticals. We look at a number of specific verticals like construction, delivery, civil government, energy, and agriculture, among many others. And then we look at the strategies being adopted by companies to address these individual areas or the area as a whole. We have profiles and analyses of 113 leading drone companies worldwide.

In addition, we look at trends in venture capital and what are the shifting priorities for venture capital investors. So the shifts in the market that have and are happening are explored on multiple levels.

The report contains an overall assessment of the market and where things stand, and I wanted to ask if there was anything that was especially surprising to you about that assessment.

One of the really interesting things was the extent to which the public sector adoption of UAS is speeding up worldwide. International agencies like the United Nations, UNICEF and World Bank are all either adopting UAS or exploring how to integrate it across their operations. European agencies like EMSA (European Maritime Safety Agency) and Frontex (the European Border and Coast Guard Agency) are moving ahead with plans to deploy UAS. They've put in place service contracts with a number of providers that will go beyond patrolling maritime borders. They're also looking at new roles like ship emission monitoring and search and rescue.

The Department of Homeland Security has operated Predators for years now, but the organization is starting to purchase smaller UAS. The Coast Guard has just put in place service contracts with Insitu. On top of that, US public safety adoption has begun to soar because the concerns we saw early on about privacy have receded, so a number of police and fire departments have begun to adopt these systems. I wouldn’t say it was surprising to see this level of adoption, but it was certainly telling.

Is it useful to think about the development of this industry in terms of a specific region? For example, we often talk about “Asia” but China is basically a distinct market in and of itself, isn’t it? Additionally, it’s simpler to talk about “Europe” but the continent is essentially a collection of individual markets that have various distinct and different opportunities, isn’t it?

Yes, countries do matter. It's important to go beyond the overall outlook for a given region. That's why the report looks at the disparities between countries in market development. We look at these issues, not necessarily with projections for individual countries, but in breakouts and discussions on the differences in the market segments.

For example, agricultural UAS is developing extremely rapidly in China due to subsidies being provided to manufacturers. There are also clear individual distinctions between individual countries and regulations that we address in the report. In Asia, China and Japan have adopted programs intended to spur the growth of the industry while India has been much more cautious. In addition to these sorts of differentiating issues, we also look at the strategies of individual companies that help elucidate these differences. So we look at numerous manufacturers and service providers. In all, we include 113 companies from around the world.

What kind of an impact would the harmonization of European national regulations for small UAS across the European Union enable for the market as a whole?

This harmonization is absolutely critical for the development of the European industry.

The current system makes it difficult for companies to operate across individual EU borders, so the result is that the market is extremely fragmented. Additionally, venture capital is reluctant to invest in European companies in large part because of this fragmented market. We found in our study that over the period from 2012 to mid-2019, Europe attracted only 9% of venture capital funding. By comparison, the United States attracted more than 7x that amount. As a result, a number of these European companies recognized that a US presence is critical, so many have chosen to move entirely to the United States or open branches or make acquisitions in the United States.

Once there is a pan-European market, Europe is going to be in a better position to develop its UAS markets and compete with the United States for capital. So Europe has made an important step in that direction with the publication of the common rules for drone utilization. Those are supposed to go into effect in about another year. Investing in a single country versus an entire continent makes a huge difference

The report talks about the industries that will continue to grow in the coming years, but the assessment of the agriculture market is something I wanted to further define. Given the diverse needs and requirements across crops and countries, will this technology ever create value at scale in “agriculture”, as opposed to creating value for all farmers in a given region or who have specific crops?

If you compare it to a sector like energy, where inspection techniques and equipment can be standardized, regardless of the region, you can see why these challenges exist. You need different algorithms for different crops and many of these are still to be defined. In addition, different soils in different areas can cause problems.

Moreover, farming worldwide has limited profitability so many farmers are averse to taking the risk in adopting a new piece of technology. Agriculture has tremendous potential, but it's going to take decades to fully develop.

How does the report assess the impact of DJI on the present and future of the market?

DJI will be a dominant player in the market in the sort and long term. They have an 80% market share in the consumer and prosumer commercial markets. They've gotten that share because the company is very agile, they have good products at reasonable prices, they continually upgrade their products to bring down prices, they have a strong supply chain in China and have also developed key alliances with US companies to provide sensors and analytics. Additionally, they have strong support from the Chinese government, which includes subsidies for their agriculture spray UAS. This combination will make it very difficult to supplant DJI in multicolor systems. The longer the FAA takes that will enable BVLOS operations, the greater DJI's ability will be to strengthen their position in the market.

Even when fixed-wing systems become feasible with BVLOS regulations, DJI is likely to move into those markets because it will have access to the capital it needs to do so. DJI was considering coming into financial markets last year for $500 million to $1 billion dollars in preparation for their first IPO. It ultimately delayed the offering, but if you think about the size of the capital that they were considering raising, it dwarfs the amounts raised by the overall industry in recent years. The figures that we compiled show that in the past two years, total venture capital funding was about $1 billion dollars. So that suggests DJI will have the capital it needs to quickly establish a strong position in fixed-wing systems as well as multi-rotor should it decide to do so. And it's very likely to further expand its position in other adjacent areas.

Does the report contain an assessment of VC investment in the space, or insights around where potential VC investment opportunities might reside? How much of that will depend on regulation?

The report looks at what the trends are. The trend for VC capital really began in about 2012, so what we've done is we've listed the top 100 venture capital-funded UAS firms and look at their financing. We look at how that funding has been shifting. Early on, it was really focused on the consumer market and manufacturing, and what we've increasingly seen is a shift to software and service companies.

In the report, we do anticipate a gradual easing of restrictions, and that will impact these opportunities. We expect the FAA to gradually give more and more companies the ability to operate over people and beyond visual line of sight. Then, in 3-5 years, we anticipate that routine operations of UAS for commercial purposes will be achieved.

What kind of insights does the report contain around market strategy, and how companies can get into the market?

For new companies trying to get into the market, the greatest challenges are associated with manufacturing. There are established players and it's a competitive space. To break into that part of the market really requires a concerted effort and some new strategies. It will be difficult.

The greatest opportunities for start-ups are really in services and software. Capital requirements are less, and there are more opportunities to avoid established companies. In terms of manufacturing drones, it's important to think of areas that might be less vulnerable to DJI and other Chinese manufacturers, so that suggests areas such as providing UAS to customers concerned about the possible diversion of data, which included Western government and companies involved in security and sensitive infrastructure. But there are many others that the report outlines and details.

What sort of opportunities do you envision this report will create for people that purchase it?

With our history in studying these markets and the focus on our research, we're confident that we have a good understanding that goes beyond a high-level look at the developments that are and will shape this market.

The civil/commercial markets are growing but also changing rapidly. Requirements and regulation are shifting. Company’s strategies are evolving. The report is designed to provide a comprehensive view of this rapidly changing space.

Purchase the 2019 World Civil Unmanned Aerial Systems Market Profile & Forecast or see what else Phil has to say about the present and future of the industry at the Commercial UAV Expo.

.jpg.small.400x400.jpg)

Comments