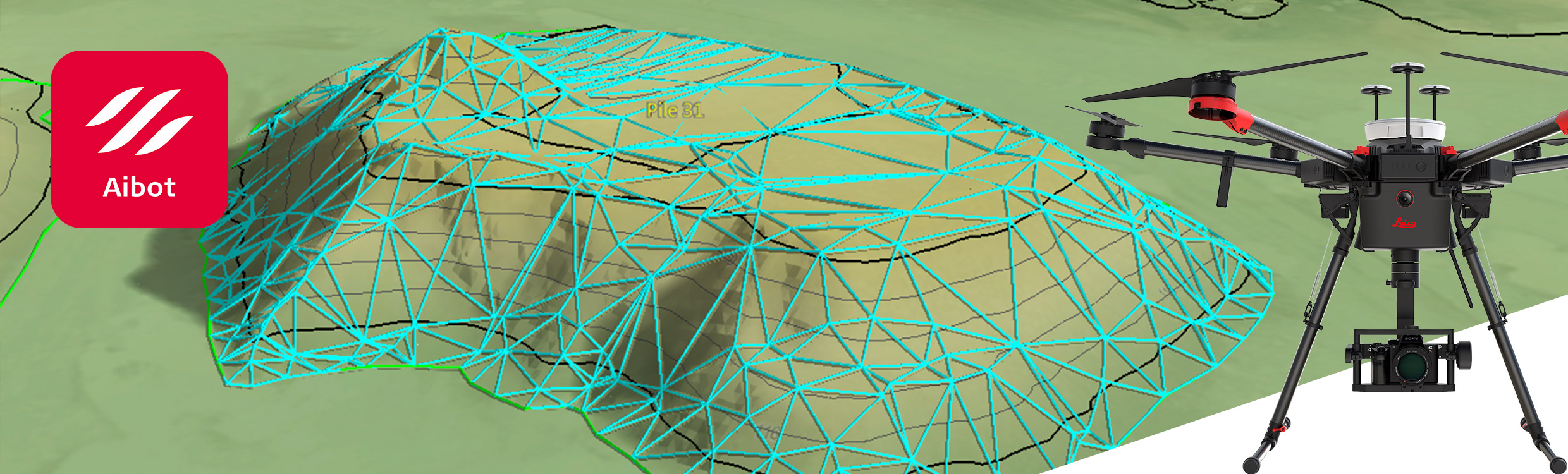

For the past 97 years now, one company has been at the forefront of manufacturing precision optical instruments for land surveying and construction. Wild Heerbrugg was founded in 1921 in Switzerland, but today is known as Leica Geosystems (part of Hexagon AB) and is recognized across the world for their surveying transits and GNSS receivers which have helped to transform these industries. Their foray into the world of mapping with UAVs has further cemented their leadership role in land surveying and construction, and their commitment to staying in this position is evident with the announcement of the new Leica Aibot.

Based on DJI’s M600 Pro aerial platform, the Leica Aibot is designed to accelerate and streamline the acquisition of mobile 3D mapping data. High definition imagery and 3D mapping allow for the viewing of site mapping or progress documentation, which is designed to help users save time and money at all stages of their project. By using an established and commercially available UAV platform rather than developing their own, the Switzerland-based geomatics solutions provider is going the opposite direction of some other surveying equipment manufacturers who seem more intent on acquiring or developing their own UAV solutions.UAV operators of all types have gone through a major learning curve over the last few years when it comes to efficiently and effectively using commercially available platforms to add efficiency to their operations. These changes and developments have been especially notable for mapping and surveying tasks, but the adoption of drones in this space has been evident and strong. The savings in this field are evident, but there have been cases where the increased analysis work ends up eating up some of these inherent advantages and slows down the delivery of the end product. These details have forced users to consider in great detail how they can and should be utilizing the technology.The announcement from Leica could illustrate that surveying equipment manufacturers are going through a similar learning process around how to approach the technology. Rather than attempt to create their own proprietary UAV hardware or solution, we could be witnessing a shift that sees companies at Leica's level focus on their core strengths as opposed to designing and manufacturing the actual unmanned aircraft platform.We've seen many manufacturers struggle when it comes to trying to create a complete drone solution that includes the hardware, software, sensors, etc. Until four or five years ago, Leica Geosystems had no expertise whatsoever in designing or manufacturing aerial platforms, but they were definitely pioneers and excelled at providing third-party aircraft with amazing sensors and GPS/GNSS receivers to add accuracy to their optic excellence. Over the past three decades, Leica Geosystems has also developed a very extensive and comprehensive suite of mapping and analysis software to be used in conjunction with their sensors to offer a complete solution. It makes sense for them to focus on the mapping side of the equation (acquisition + software) and leave the aerial platform to established manufacturers such as DJI.Not too long ago, Trimble sold off their unmanned platforms in order to focus entirely on supplying UAV manufacturers with the best possible GNSS and inertial platforms to guarantee precision. This development signifies a similar shift for Leica in terms of conveying that they're going to be focused on providing real value for users, as opposed to trying to create and offer every single part of a complete drone solution.By partnering with DJI in this way, Leica Geosystems can free up resources to focus on the development and sales of their traditional sensors and software. The results of this new focus can be combined with existing survey technologies, such as a total stations, GNSS and laser scanning, to provide a more complete set of information that users can leverage in new and more powerful ways. This kind of holistic approach to incorporate a variety of data sets and perform data analysis can open up brand new opportunities related to efficiency and savings. These results of doing so have already proven to be as impressive as they are powerful.We will be following these developments closely, especially when it comes to how this news might represent and even guide the inevitable consolidation of the industry that so many are talking about and waiting to see happen.Subscribe

The information you submit will be stored and used to communicate with you about your interest in Commercial UAV News. To understand more about how we use and store information, please refer to our privacy policy.

June 26, 2018

Leica and DJI Join Forces to Bring a New Drone to Market

Comments