As the year approaches its end, now is the perfect time to reflect on the performance of the drone industry in 2025. All corners of the industry had a busy year with technological developments, mergers and acquisitions, and navigating new tariffs.

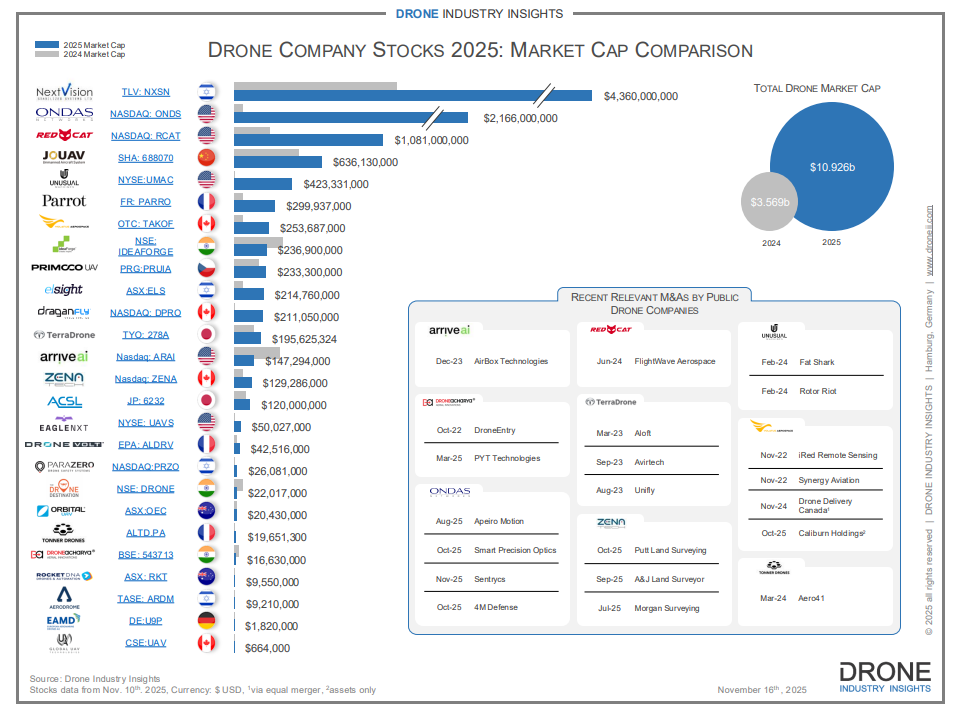

To get a pulse on the industry’s financial performance, Drone Industry Insights recently published an article analyzing public drone companies market activity in 2025. Taking data from drone manufacturers and unmanned technology companies from all over the world, the results speak to the value of each company’s business model, not just their products or services.

Diverse Companies Outperform the Rest

Throughout the report, it was mentioned multiple times that companies that have broad offerings and don’t serve a niche market are more resilient than their counterparts. The article specifically points to Ondas Holdings and Redcat Holdings as examples within this group, explaining that they “mitigate risk by diversifying their focus across multiple products, building portfolios that encompass automation technology, AI, and drones in hardware, software, and services.” While it can be lucrative to tap into niche markets where we see demand, this research shows it pays to cater to everyone’s needs.

On the other hand, the article points out the success of mid-sized companies who have stuck to their niche markets this year. It’s important to note that the key to their success was thanks to “stable and long-term industrial contracts.” These are the companies that are getting consistent income from their clients and therefore running a stable and profitable business. While it might not be flashy or exciting, it’s dependable for their investors.

Industrial Markets are the Strongest

This research shows that companies with industrial applications prove a clear operational value and continue to attract significant valuations. These are the types of companies that are steady and instill confidence in their investors. This article specifically looks at JOUAV, a Chinese drone manufacturer that supplies drones for surveying, mining, surveillance, and oil and gas industries that had a valuation of $636 million this year. This company has proven its product’s value through the benefits it brings to infrastructure used by the general public every day such as performing traffic inspections or emergency response situations. Investors look at this as a practical and effective way of using drones that will grow in the future.

“These firms may lack the excitement of hypergrowth stories, but their predictable revenue streams from large enterprise clients offer a solid foundation for sustainable public company operations,” as stated in the article.

Investors look at this as a practical and effective way of using drones that will grow in the future.

Beyond the Hype Stage

We have talked about how the drone industry has come out of its infancy, and that includes stakeholders making smarter investments, not in companies who have the most hype around their product. The industry is now advanced enough to see the value and longevity of business models that support other industries and are not solely focused on flashy products. Investors are thinking long-term, looking past flashy hardware and focusing on companies that deliver real operational value, stable contracts, and technologies that enable entire ecosystems.

Looking ahead into 2026, its clear that we will continue to see this maturity carry on with new and established public drone companies. The industry has entered an era defined by proven value, strong fundamentals, and thoughtful diversification, and not one of hype unable to withstand the ebbs and flows of the industry. Companies that have a strong foundation based on tried-and-true business models, industrial applications, and enabling technologies will continue to earn investor confidence.

Comments