On April 25, the principals at Eve, the Embraer spinoff trying to develop the first commercially viable air taxi or eVTOL (electric vertical takeoff and landing) craft, held a public webinar in which they elaborated on their plans to go public through a merge with a SPAC (Special Purpose Acquisition Company) in Q2 this year.

Eve co-CEOs Andre Stein and Jerry DeMuro held a Zoom session sponsored by IPO Edge in which they went to great lengths to describe not only their technology but the process of turning the company into a publicly traded enterprise.

“Even though the SPAC marketplace today is not in the best possible shape, we have determined that it’s the best way to take Eve public,” said DeMuro.

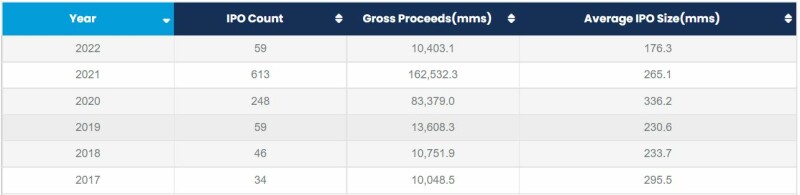

It is true that the SPAC fever of last year is gone, and even though there are still deals taking place, the amounts involved are a fraction of 2021.

“The fact that Eve is supported and openly backed by the third largest aircraft manufacturer in the world, Embraer, gives the company an edge that none of our competitors have.” Said Stein, “We were born out of EmbraerX, the disruptive technology accelerator of Embraer, and we plan to continue the tradition of being leaders in our respective market niche.”

Embraer is widely considered to be the leader in the regional jet market with the e-jet family and in a specific segment of the business jet sector with the Praetor and the Phenom. We can only guess the collaboration and the contributions that the Embraer engineers and designers poured into the Eve design, but it is obviously a great advantage over startups that are not supported by aerospace giants.

“We have secured, so far, 1,825 future aircraft sales through various internal and external promotional efforts, and we expect that number to grow once we have a production model,” said Stein. “According to KPMG, the global market for air taxis is expected to top 1 trillion dollars, and we plan to grab a considerable portion of that market, not only in the USA, but all over the world.”

“The aircraft will be autonomous-ready from day one, but at the beginning it will have a pilot and four passengers,” Stein said. “Eventually, the pilot will be removed, and it will fly with a six passenger configuration in fully autonomous mode.”

DeMuro elaborated on the different obstacles that the AAM (advanced air mobility) technology is encountering today with regulators. “We don’t expect the USA to be the first market to open its skies to air taxis. We think this will happen in smaller markets, and we are taking full advantage of Embraer’s existing support infrastructure in over 80 countries,” he said. “With a strong presence in Brazil and other emerging markets and a close relationship with regulators, we expect these aircraft to be testing the waters for regularly scheduled flights soon.”

Regarding the financial details of the transaction, Eve will be publicly traded through a New York Stock Exchange listing after completing a merger with Zanite Acquisition Corp, the SPAC in question. On May 9, Eve and Zanite announced the completion of the business combination between Zanite Acquisition Corp. and Eve UAM, LLC.

Once Eve goes public it will join the ranks of Joby, Archer, and many others who are ferociously competing for a leadership role in a market that, even not in the short term, will be huge in terms of revenue and potentially profits.

Comments