A hot topic in the drone industry has always been about how we can get drone operations to scale. The industry is dynamic and changes daily, if not hourly. With the many complex logistical challenges companies are facing to build their businesses, no one wants to spend a lot of time dealing with complicated, expensive, rigid, insurance policies. This is why companies like Flock, which offers bespoke, flexible insurance policies, are enabling the enterprise to scale without having to jump through complex hoops to insure their fleet.

Flock is able to intelligently price their insurance policies for the enterprise by basing their quotes off data collected directly from an organization's flight management software. This means quotes are based off of actual exposure to risk, rather than a predefined set of risk factors. From this data, Flock provides customers with actionable risk insights. This enables companies to further reduce their premiums and see more return on their investments.

What this can mean for the enterprise has been demonstrated within the precision agriculture industry, where the needs for insurance coverage changes according to the seasons and the risks can change daily. In this industry, being stuck with a rigid insurance company with a set premium, regardless of frequency of use or risk factors, almost always means unnecessary costs.

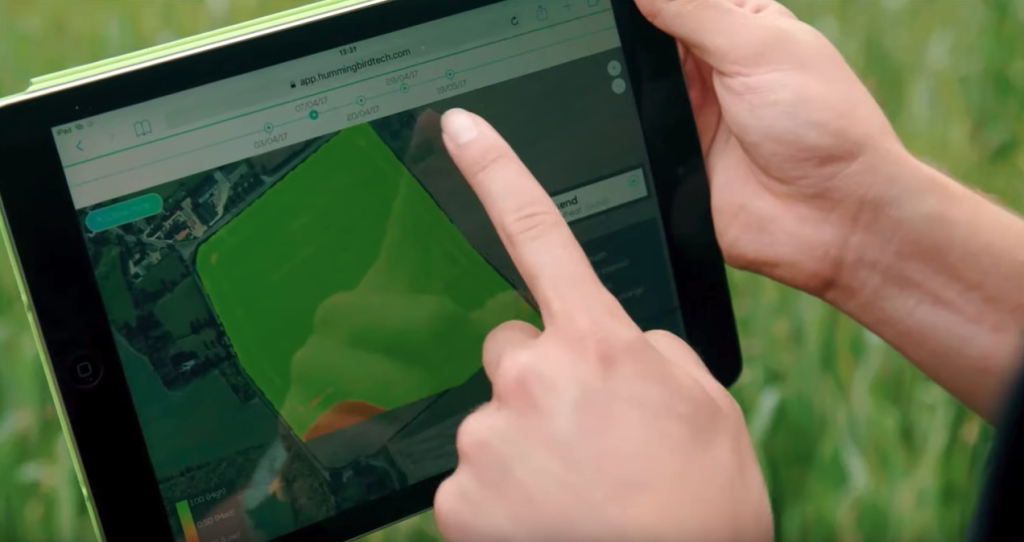

Recently, Hummingbird Technologies, an imagery analytics company serving the agriculture industry, spoke about how switching to a flexible insurance policy has impacted their business by improving their ROI. From being able to scale down their coverage during the winter months when they aren’t flying as often to gaining insights into how they can mitigate risk and reduce costs, Flock has made a difference to their bottom line.

Watch the full interview below.

Comments