Whether in Europe or North America, observing different approaches to technology deployment and business is probably what I have found most interesting in my line of work. That’s something I was able to get a close look at during the first edition of Commercial UAV Expo Europe, and I was able to get an even better sense of that this year in Amsterdam, as presenters and attendees explored where and how they are or will be utilizing UAV technology. While there might be some similarities in approaches to familiar business problems, there are many differences in the operational and geographical contexts that we see on both sides of the pond.

Mantas Veskela introduces their BVLOS UAV inspection project in Romania

BVLOS operations in Central and Eastern Europe

I was pleased to see Mantas Vaskela of Laserpas UAB presenting again, this time sharing the stage with his customer. Iulian Bogden of Distributie Energie Oltenia, a power distribution network operator (DNO) in southern Romania, joined Mr. Vaskela to detail what the inspection of 600 KM of power lines looks like. It provided much different and more powerful look at what it means to use the right tool in the right context.

Last year we heard about the processes and experiences when undertaking BVLOS operations in Central and Eastern Europe. Project requirements included identifying an exhaustive set of risk factors to the DNO’s infrastructure. Not only did these factors include those related to vegetation management, but also condition information related to the towers and other supporting structures.

From a sensor point-of-view, I hope that Mr. Vaskela does not object to me referring to a ‘brute-force’ approach where it appears practically every sensor available to the project team was mounted on the payload configurations used. One can only speculate on the volumes of data that needed to be sifted through by a data interpretation team.

What was especially interesting was how it provided a different perspective than the one prevalent in North America in terms of the adoption of BVLOS flight operations. Doing so allowed the team to not only collect data in one pass but to also minimize field costs as far as possible. Many in North America would look to utilize a manned aircraft solution at this scale, but what may further surprise North American audiences are the assumptions applied when deciding between these options.

In Laserpas’ view, it is more cost effective to deploy BVLOS UAVs on the largest projects, where relatively shorter lengths of network need to be captured as opposed to a manned solution. Laserpas went on to explain the reasoning behind this, as he mentioned how in many situations it is much more economical to deploy a manned rotary platform to collect the data and move on.

With civilian BVLOS flight operations in the US and Canada still being quite a way behind Europe, I wonder how long it will be before UAV service operators in North America will routinely be presented with such a choice? Will differences in scale and geography mean that they will come to similar conclusions? What other factors will impact this choice? Potential changes to regulation in the United States mean these kinds of decisions might need to be made sooner rather than later.

James Veakins from Hanson outlines how UAV surveys drive business decisions at Chipping Sodbury quarry

Focus on downstream processes

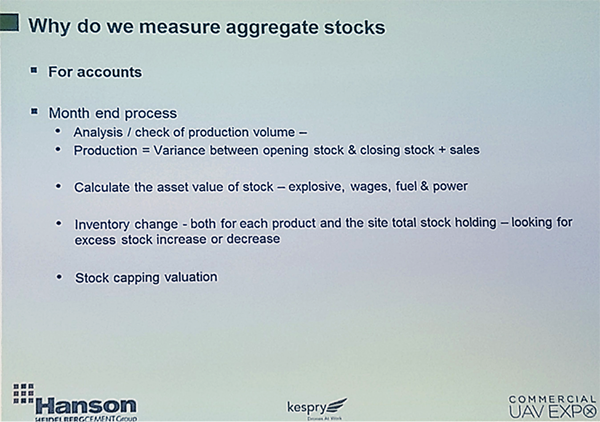

James Veakins from Hanson’s Chipping Sodbury quarry in the south west of England presentation focussed on the downstream requirements of a UAV implementation. It was a worthwhile topic for him to explore since consistent reporting of stock volumes is so critical to the management of the quarry and decisions made regarding the sale of materials from it.

Running an SAP inventory management solution of the quarry, stock consolidations have typically been undertaken on a quarterly basis. Stockpiles have been surveyed by external contractors using traditional methods. This approach is especially costly, but it’s not just about the expense because this approach carries such a huge safety risks. In the UK there were two fatalities when site personnel walked on quarry stockpiles last year. Additionally, this approach isn’t even all that effective. The frequency of surveys does not provide information to the granularity required to drive sales efforts.

With the implementation of the Kespry stockpile measurement solution, the quarry can collect the volumetric data at a significantly reduced health and safety risk and at a much higher frequency (weekly surveys are the target). Additionally, this approach significantly lowers the per-survey cost since the data collection is completed by in-house staff. Simply put, this UAV implementation at the quarry enables the quarry management team to collect data and make decisions that they would not have been able to otherwise.

Business drivers for measuring stock piles – why use that drone in the first place

These are differences we’re literally seeing all over the world though. We saw Sumac present at the International Lidar Mapping Forum on very similar business context for stockpile monitoring. Details there focused on how we should increasingly discuss and measure the value from UAV stock measurement activities through considering variables that go beyond just the time and accuracy of a survey.

There are many similarities between the reasons Sumac’s customers and Hanson utilize UAV based stock measurement services. The differentiator between the two operations is interesting though. Serving biomass processing plants at pulp and paper mills in Northern Ontario, Sumac are employed as a contractor on their stock measurement projects, because of the relatively high value of the biomass stock. If there is a small error in the measurement method, this can lead to a significant impact to their customers balance book and supply chain logistics to that site. For this reason, Sumac as a specialist geomatics firm are employed and while automated, the methods applied to process the data are not completely automatic, with checks and balances in places that involved trained interpreters at specific stages in the reporting procedure.

In the case of Hanson, the relative value of the limestone material is much lower and measurement tolerances required to make relevant decisions are larger. Consequently, the fit-for-purpose solution required can be much more automatic and deployed by non-survey staff. This illustrates a great example of how the business requirements can and should guide the choice of technology, rather than the other way around.

Similar business requirements, different operational contexts

These presentations were focused on business and project requirements, rather than what type of UAV implementation was employed. That’s as significant as it is powerful, because those requirements are what should drive the decision on the implementation of a new solution. Similar problems arise in Europe and North America when people allow the technology to lead the project, and those kinds of challenges were directly and indirectly referenced throughout the conference.

What I found most interesting about these projects, was while they both highlighted the importance of the information collected by the UAVs in the downstream business, the operational contexts dictated how the UAV solution was implemented. Regardless of flight regulations, the type of material being measured, or the specialist knowledge of the UAV flight personnel, the right things were being considered as decisions were being made. That bodes well not only for the European and North American drone market, but for the industry as whole.

Comments